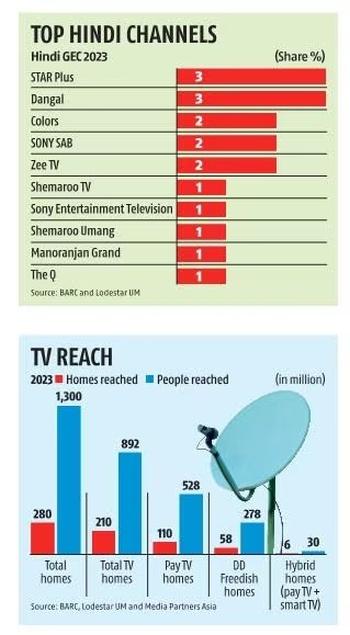

DD Freedish is the 'largest TV platform in India', going to 58 million homes, featuring 70-odd private channels.

DD Freedish reaches about 278 million people, and is easily among the top five TV platforms in the world.

The serial Bak Bak Baklol features YouTube comics Pankaj, Sweety, Guddu Bhaiya, Riddhu among others.

The production quality and jokes seem cheesy, especially if you watch popular OTT shows.

Yet it has, along with Bhains Ki Taang, Balveer and Daravni Kahaniyan made The Q one of the ten most watched Hindi general entertainment channels on TV in India.

The list includes Shemaroo Umang, Shemaroo TV, Manoranjan Grand and Dangal.

These are among the 70-odd private channels powering the growth of DD Freedish, which at an estimated 58 million homes is "the largest TV platform in India," said Hiren Gada, CEO, Shemaroo.

It reaches almost 28 per cent of India's 210 million TV homes and is easily among the top five TV platforms in the world.

The only service closest to it in India is Tata Play with an estimated 22 million homes.

The rise of DD Freedish emphasises that linear TV continues to grow, albeit on different distribution platforms.

More importantly it draws attention to the free programming ecosystem that is, possibly, the biggest shift in the Rs 1.61 trillion Indian media and entertainment business.

That a State-controlled DTH operator is, along with YouTube, at the centre of this ecosystem is remarkable.

Of the 892 million people TV reaches, DD Freedish reaches about 278 million.

On the other hand, YouTube reaches 462 million Indians. These are not mutually exclusive audiences.

A lot of people who watch TV on DD Freedish could also be viewers of YouTube and vice versa.

Between the two they corner roughly 15 per cent of all the money spent on advertising, across media, in India.

YouTube made an estimated Rs 8,000 crore (Rs 80 billion) in ad revenue. And though DD Freedish doesn't get that money, because it prefers to operate only as a distribution platform and makes its money from an annual channel auction, advertisers spent Rs 3,000 crore (Rs 30 billion) on the channels broadcasting on it.

YouTube's growth reflects that of streaming. But how does one explain the phenomenal growth of a linear TV service like DD Freedish in the past three or four years?

"It took off because you could buy open STBs [set-top-boxes]," explained Shashi Shekhar Vempati, former CEO, Prasar Bharati, the corporation that operates state-controlled media.

You can buy a DD Freedish set-top-box and dish for between Rs 1,000 and Rs 1,500. You install it yourself and are good to go.

There is no subscription, no recurring payment, nothing.

It offers 167 (free and unencrypted) channels of which 90 are Doordarshan and other educational channels.

The remaining 77 are private channels for which Prasar Bharati holds an auction every year.

This year it netted over Rs 1,070 crore (Rs 10.70 billion) from the auction of 65 channels, each of which paid from Rs 6 crore (Rs 60 million) to Rs 24 crore (Rs 240 million) to be on the platform. That is up from about Rs 700 crore (Rs 7 billion) in 2022.

"The bidding scale is an indication. There is no large general entertainment channel on DD Freedish, yet its revenue continues to rise," said Bharat Ranga, managing director, Beginnen Media, pointed out.

DD Freedish was launched in 2010.

In 2015, when "the Broadcast Audience Research Council started reporting rural data, Hindi channels saw their numbers jump," said Vempati.

That is when the rural and small town audience and, therefore, DD Freedish finally came into play.

Many of the big broadcasters took their free-to-air channels like Star Bharat or Zee Anmol on DD Freedish with great success.

After that, two things helped push it to over 43 million, reckons Constantinos Papavassilopoulos, media analyst formerly with Omdia.

"The first is cord-cutting prompted by the growth of the OTT video market. The second is the introduction of stricter regulation in the form of the New Tariff Order(s)," he said.

The three tariff orders, which came in quick succession from 2018 onwards, complicated choices and pushed up prices, forcing millions of viewers away from pay TV even as streaming was rising.

The ones who could afford to, moved to OTT, others went to DD Freedish.

The pandemic accelerated this trend. "Pay TV has gone down by 15 million but DD Freedish has increased. A lot of the pay TV homes go to DD Freedish or hybrid (homes that have a smart TV plus some DTH/cable connection)," says Mihir Shah, vice president, Media Partners Asia.

Much of DD Freedish's growth has come from the small towns and rural India where DD Freedish is the first TV connection. That explains why free or repurposed programming works there.

"Channels like us are targeting smaller towns and young India resonates with the creator economy. We take the best of YouTube and digital creators and licence to put that on linear," said Simran Hoon, CEO, QYOU Media India.

That brings this to the first of the two limitations of DD Freedish.

The first is that its reach and power are limited "to the Hindi heartland and a little bit of Maharashtra," says Anuj Gandhi, founder, Plug and Play Entertainment, and a former television executive.

He points out that DD Freedish is very strong in Uttar Pradesh, Rajasthan, Chhattisgarh, Bihar and Jharkhand.

Note that these are states with low cable and DTH penetration unlike the south and Maharashtra.

That brings up the question: Is DD Freedish the poor man's TV that works in states with low per capita incomes and poor infrastructure? Broadcasters and analysts disagree.

"It is a chicken and egg situation. There is no content (in non-Hindi languages) therefore there are no viewers. And there are no viewers in those languages therefore there is no content," said Gada.

There is some thought being applied to getting more languages on board, say insiders. Soon, there could be more Bengali and Assamese channels to start with.

The second is its complete lack of addressability.

Would DD Freedish not gain from knowing exactly how many and what kind of homes it reaches and from pricing its auctions more accurately based on this?

Vempati pointed out that DD Freedish is played in border areas and other places where Indian television and radio wouldn't normally go.

"Why encrypt this soft power?" he asks.

But not encrypting and having an annual auction for slots means that there is no stability.

Dangal might be on DD Freedish one year and not the next.

Unlike other DTH operators such as Tata Play or Airtel Digital TV, "most advertisers don't have a handle on what shifts can happen because the channels change every year. So we cannot do a fixed plan," said Shrikant Shenoy, associate vice president at media buying agency Lodestar UM.

To get around the problem the agency checks the channel list every quarter to figure out the free channels' clients, such as ITC or J&J, that need small-town reach, could be advertising on.

That however hasn't stopped growth for now.

Media Partners Asia estimates that DD Freedish will reach 67 million homes in the next five years even as pay TV continues to drop.

Feature Presentation: Rajesh Alva/Rediff.com